[ad_1]

The stocks were purchased by US-based, Australia-listed GQG Partners. Money raised from the share-sale will be used to shore up liquidity and to strengthen the balance sheet as the family led by Gautam Adani continues to rebuild the confidence of the investors in the aftermath of Hindenburg Research’s bombshell report on its business practices that lopped off billions of dollars in m-cap.

This is the third time GQG, which was founded in June 2016 by India-born Rajiv Jain, along with Tim Carver, has ploughed money into Adani Group companies.

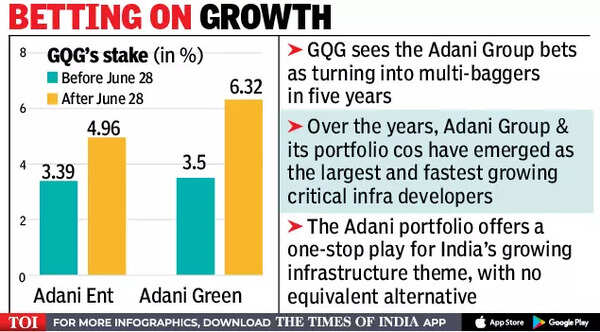

The asset manager, which had a total of $92 billion under management in January this year, now owns 6. 32% of Adani Green Energy, 4. 96% of Adani Enterprises, 4. 1% of Adani Ports and 2. 45% of Adani Transmission. On Wednesday, it bought shares of Adani GreenEnergy and Adani Enterprises, giving a further boost to the conglomerate as shares of its listed companies continue to enjoy a dream rally on the stock market.

Bulk deal disclosure on the NSE showed S B Adani Family Trust sold 1. 6% in flagship Adani Enterprises for Rs 4,140 crore, while Infinite Trade & Investment sold 2. 9% in Adani Green Energy for Rs 4,232 crore. The two stocks were sold at a discount to their closing prices.

GQG first invested in Adani Green Energy and Adani Enterprises in March this year. It had bought shares of Adani Enterprises and Adani Green Energy worth $640 million and $330 million respectively from the promoter family. Besides these two, it also bought shares worth $900 million of Adani Ports and Adani Transmission from the family. Later, GQG purchased Adani Group stocks including Ambuja Cements from the open market. On Wednesday, it further pumped money into the Ahmedabad-based airports-to-apples conglomerate, raising its total investment to more than $3. 5 billion.

GQG’s chairman and chief investment officer Jain previously said that it plans to become one of the largest investors in the Adani Group, depending on the valuation, after the family. The asset manager’s latest investment comes after the boards of Adani Enterprises and Adani Transmission in May approved a $2. 5-billion (Rs 21,000-crore) fund-raise plan through share issuances to qualified institutional investors.

[ad_2]

Source link