[ad_1]

“The 2021 IPO overvaluation and the subsequent correction in 2022 were both driven by factors external to the businesses,” said Ravi Srivastava, partner & head of research, Bay Capital Investment Advisors.

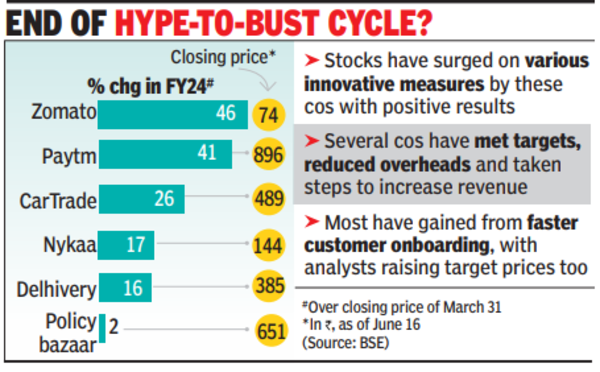

“Today, there is a better understanding about these businesses in the public market and their fundamentals are what the market is tracking and reacting to. ”Consider these: Zomato, the food delivery major that in July 2021 listed at Rs 126, went down to a low of Rs 41 and is now at Rs 74, close to its IPO price of Rs 76. The stock is up 46% in FY24. Likewise, other consumer tech companies have rebounded too in current fiscal (see graphic). Recently, several brokerages have also come out with positive reports on some of these companies. Most of these have raised target prices after analysts said that the managements were meeting their targets, cutting costs, and implementing new strategies to increase revenue.

A recent ICICI Securities (I-Sec) report on Paytm noted the positive cycle of customer growth, retention and crossselling playing out for the company were encouraging. “Customer on-boarding and increase in use cases are helping growth. The new technologically advanced platform (with 10x more transactions compared to current volume)…could be a strong lever ahead. ”

Analysts at I-Sec believe that Paytm’s “ability to grow, retain and cross-sell as illustrated should give confidence to the investor in the wake of possible changes in the payment landscape”. It added, “Increasing monetisation of the UPI platform and introduction of credit cards in UPI could lead to positive surprises ahead. ” The broking house has put a target of Rs 1,055 for the stock.

Similarly, analysts at foreign broking major Jefferies are bullish on Delhivery. “We believe current price factors in less than 10% express parcel growth in the next 3-5 years vs 30%+ levels seen in the past,” it noted. Jefferies has a price target of Rs 570 for Delhivery.

According to Srivastava of Bay Capital, businesses like PB Fintech, Delhivery, Paytm as well as CarTrade have done exceptionally well. “All of them are growing much faster than underlying industries and the non-linearity in their operating margin structure is becoming visible. Moreover, each of these franchises have a very strong balance sheet position and no cash burn, which gives them a clear advantage over private market peers. ”

[ad_2]

Source link