[ad_1]

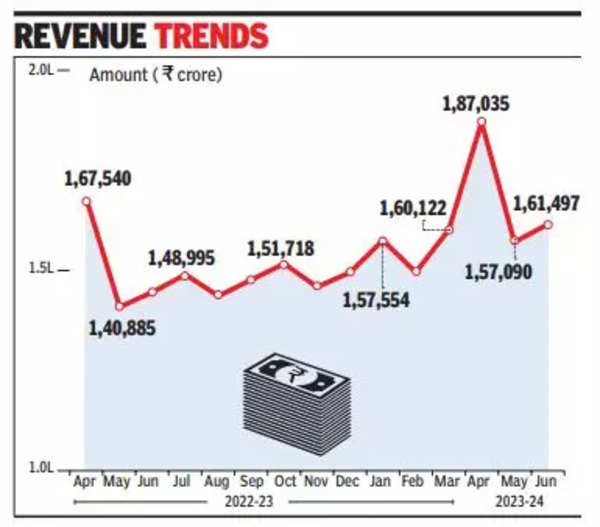

Data released by the finance ministry showed that gross GST revenues crossed the Rs 1.6 lakh crore mark for the fourth time since the implementation of the tax reform on July 1, 2017. Collections have been Rs 1.4 lakh crore for 16 months in a row and Rs 1.5 lakh crore for the seventh time since the rollout. The average monthly gross GST collection for the first quarter of financial year 2021-22, FY 22-23 and FY 23-24 are Rs 1.1 lakh crore, Rs 1.5 lakh crore and Rs. 1.7 lakh crore, respectively, according to a finance ministry statement.

At the GST Day function, Sitharaman said, “Now the collections have improved. The new normal is being talked about. If only the fake invoices and the fraudulent claims, nearly Rs 14,000 crore which is part of the fake claims, you can imagine to what extent that also will be adding to the tax buoyancy.”

The FM said the introduction of GST has actually brought the net actual tax on the consumer down and in some cases remarkably down. “It is a fact that GST has made life easy, GST has made life easy for small businesses and GST has made it easy for goods to move freely in this country,” she said.

Sitharaman said on many common goods items the tax incidence under the GST has been much lower compared to pre-GST era, adding that the number of taxpayers registered in GST has almost doubled to 1.4 crore in June 2023 from a relatively small number of 67.8 lakh in July 2017.

Calling for dispelling the myth that GST is not delivering for this country, the FM said on the contrary it has brought relief to the taxpayer and to the businesses which depend on it.

Citing data, the FM said revenue buoyancy for states has increased after the implementation of GST as she praised the indirect tax department for their work in the smooth functioning of the tax reform measure.

The finance ministry data showed that the government had settled Rs 36,224 crore to CGST and Rs 30,269 crore to SGST from IGST. The total revenue of Centre and the states in June 2023 after regular settlement is Rs 67,237 crore for CGST and Rs 68,561 crore for the SGST. During the month, the revenues from domestic transactions (including import of services) are 18% higher than the revenues from these sources during the same month last year.

“These collections, coming on the sixth anniversary of GST, would give policymakers room for comfort as the collections during Q1 FY24 are 12% higher than Q1 FY23. They indicate the extensive focus of authorities on compliance and ongoing audits have streamlined the approach of all businesses towards GST. The fact that state-wise collection growth is in the band of 10 to 20% for many of the large states would also indicate that uniformity of the growth and centralised approach to building tax compliant behaviour,” said M S Mani, partner at consulting firm Deloitte India.

[ad_2]

Source link