[ad_1]

Investors should “steel” themselves for a potentially challenging week ahead, with a number of earnings reports that could serve as indicators for the broader economy, CNBC’s Jim Cramer said Friday.

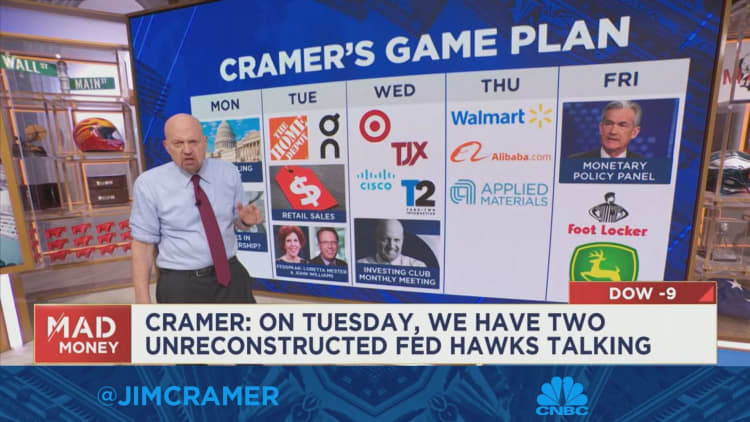

Key numbers on retail sales come out Tuesday alongside earnings from Home Depot while Target reports earnings the following day.

Those reports will be helpful in parsing the state of the economy, Cramer said, especially the retail data on Tuesday that might show “some real cracks in consumer spending.”

On Wednesday, networking powerhouse Cisco and video game maker Take-Two Interactive report earnings, and Cramer thinks that Take-Two “might be due for a change of fortune,” given how unhappy CEO Strauss Zelnick was with performance in the prior quarter.

On Thursday, reports come in from retail and e-commerce juggernauts Walmart and Alibaba. Cramer thinks Walmart’s subscription service, Walmart+, has been “gaining momentum.”

On Friday, Cramer said Federal Reserve Chair Jerome Powell’s appearance on a monetary policy panel could give investors some insight into Fed thinking and potentially into the banking crisis that’s unfolded over the last few weeks.

The debt crisis is looming and until lawmakers find a solution, Cramer warned that investors should move with caution.

[ad_2]

Source link