[ad_1]

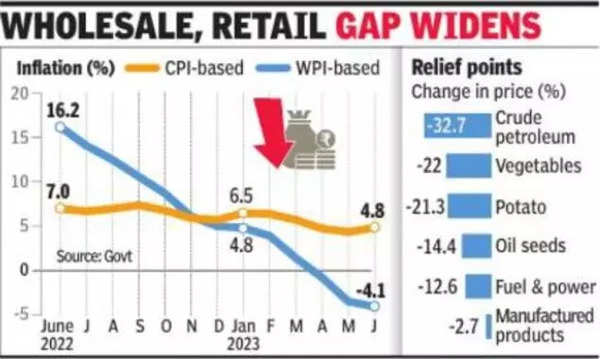

Data released by the commerce and industry ministry on Friday showed inflation, based on the wholesale price index (WPI), fell 4. 1% in June, sharper than the 3. 5% in May. The contraction in the rate of inflation in June, 2023 is primarily due to fall in prices of mineral oils, food products, basic metals, crude petroleum & natural gas and textiles, according to the government statement.

Earlier this week, data released by the National Statistical Office (NSO) showed retail inflation rose to a threemonth high of 4. 8% in June, higher than the 4. 3% in May. The food index rose to 4. 5% during the month from nearly 3% in May. Vegetable prices contracted 22% and manufactured product prices declined 2. 7% in June. Prices of cereals and pulses remained firm, mirroring the stubbornness in retail inflation data. Experts said the Reserve Bank of India (RBI) is likely to extend its pause on interest rates and watch the situation. Moderating inflationary pressure had prompted the central bank to pause its interest rate raising cycle.

“WPI fell further in deflation in June, and with CPI inflation rising faster than expected, the gap between wholesale and retail inflation continues to widen. We expect retail inflation to inch up this quarter led by food prices. The higher-than-expected June CPI print and the likely higher trajectory for July led us to raise our average CPI inflation forecast for FY23-24 to 5% from 4. 7%,” Barclays said in a note.

“Thus, the slowdown in core CPI inflation will likely only be gradual. Accordingly, we see the gap between CPI and WPI inflation widening. We think the recent spike in food prices may caution the RBI, but we still expect it to stay on hold for an extended period, without dropping its guard on inflation,” the note added.

[ad_2]

Source link